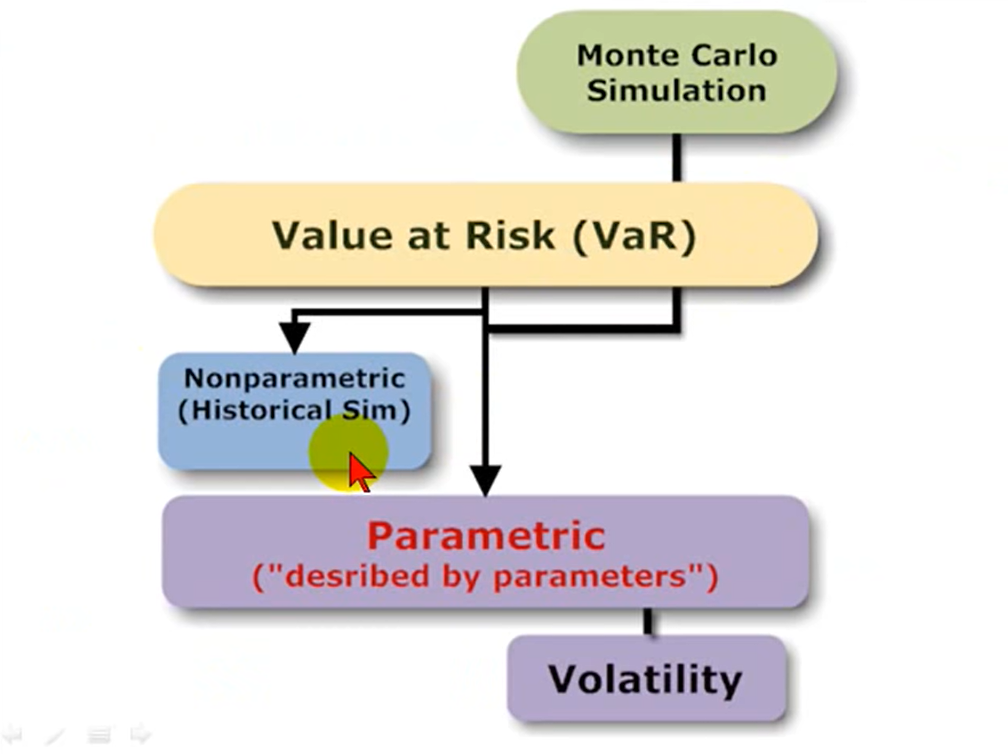

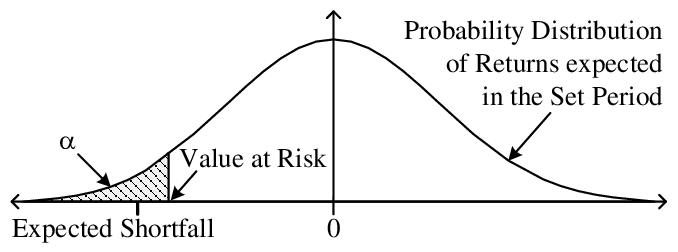

Here we show a visual depiction of the Value‐at‐Risk (VaR) estimation... | Download Scientific Diagram

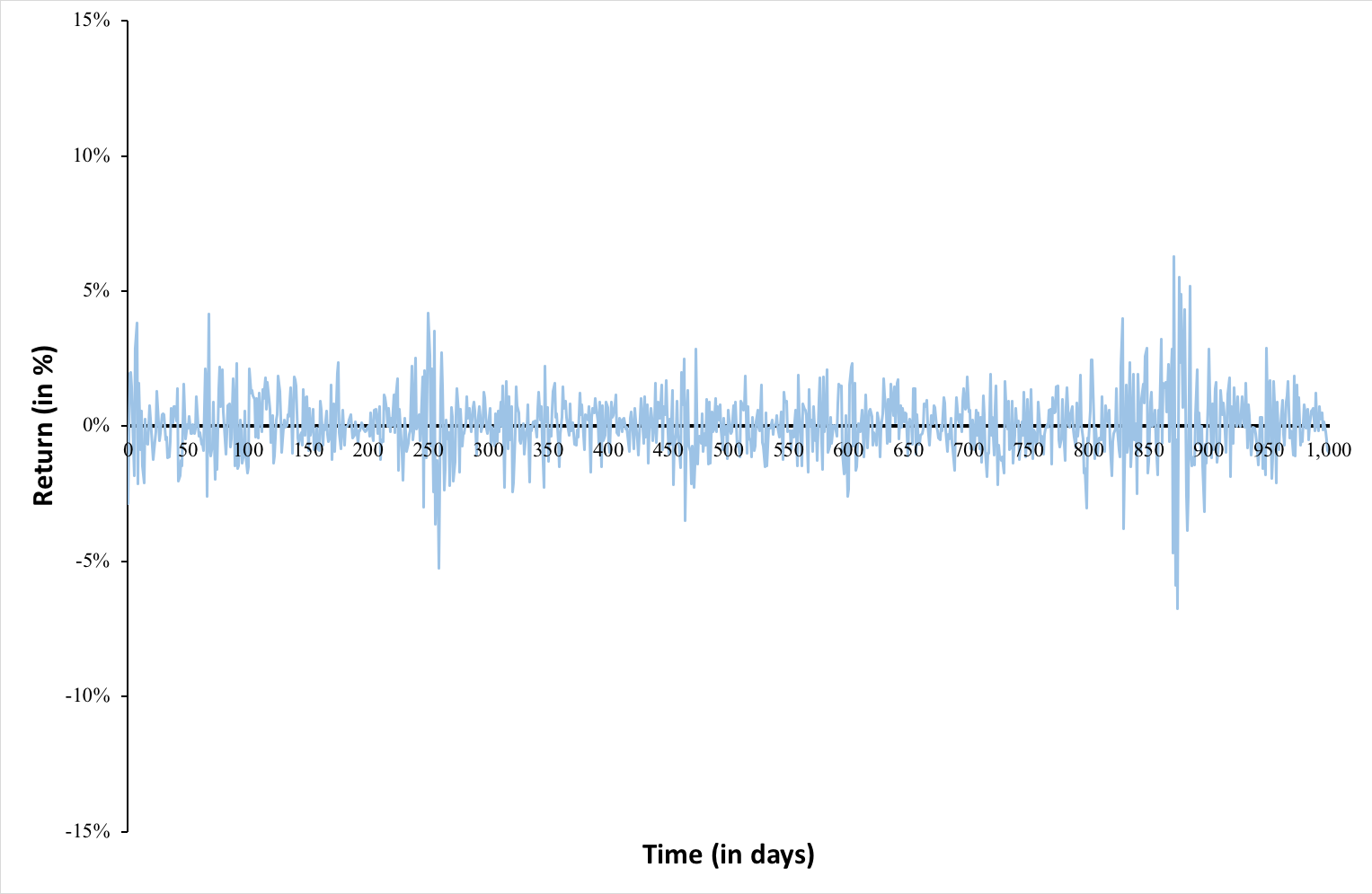

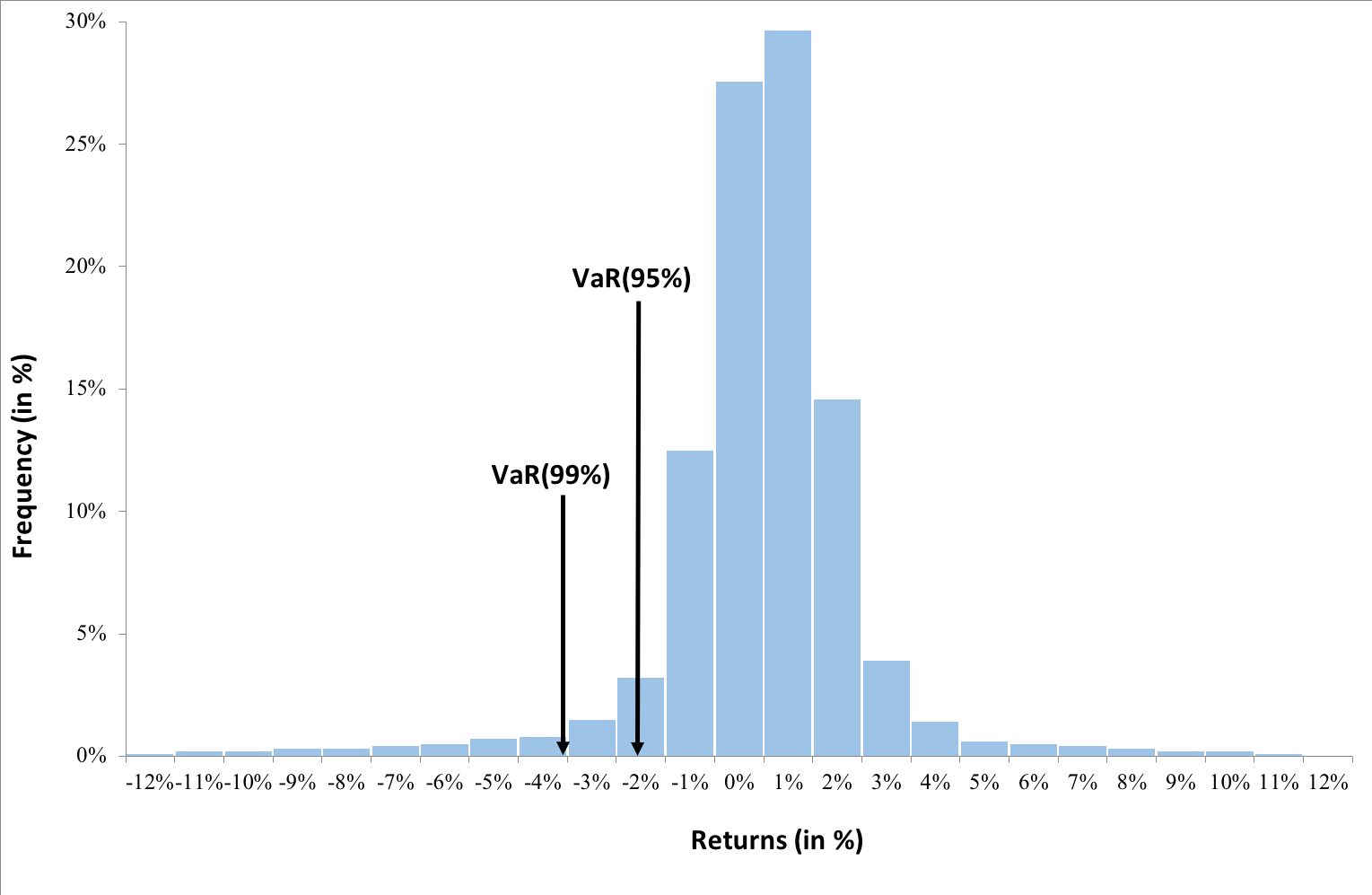

Monte Carlo simulation approach to calculate Value at Risk: application to WIG20 and mWIG40 / Metoda symulacji Monte Carlo w obl

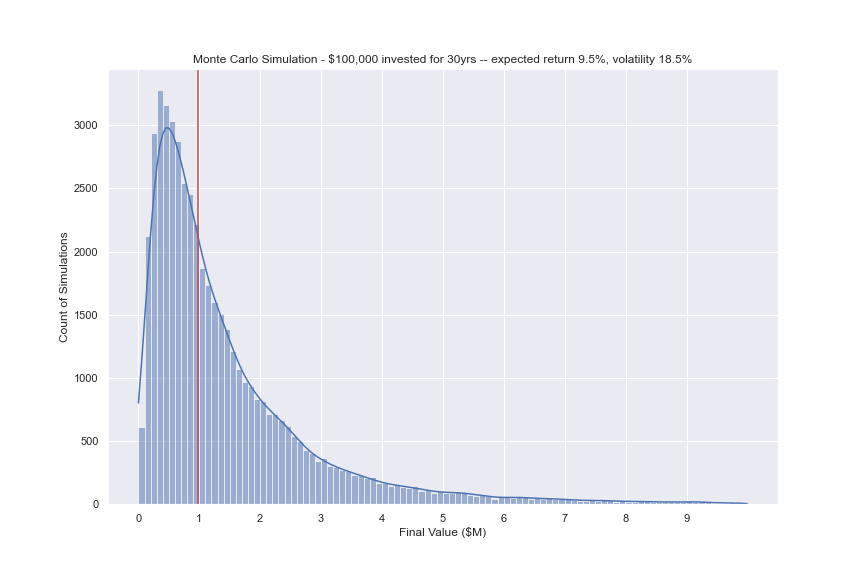

Sample Value-at-Risk estimates using the Monte Carlo simulation method... | Download Scientific Diagram

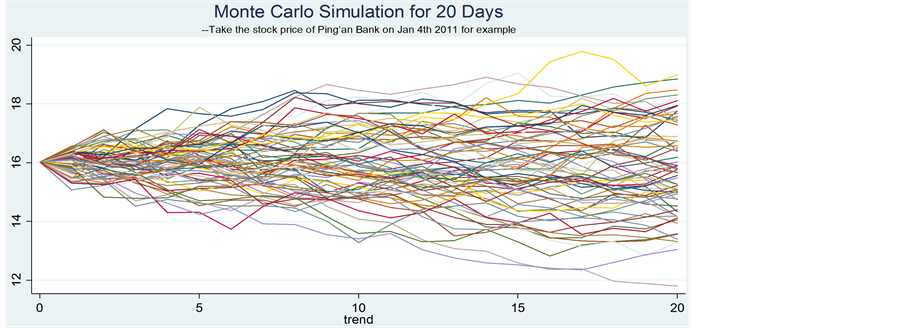

Does the VaR Measurement Using Monte-Carlo Simulation Work in China?—Evidence from Chinese Listed Banks

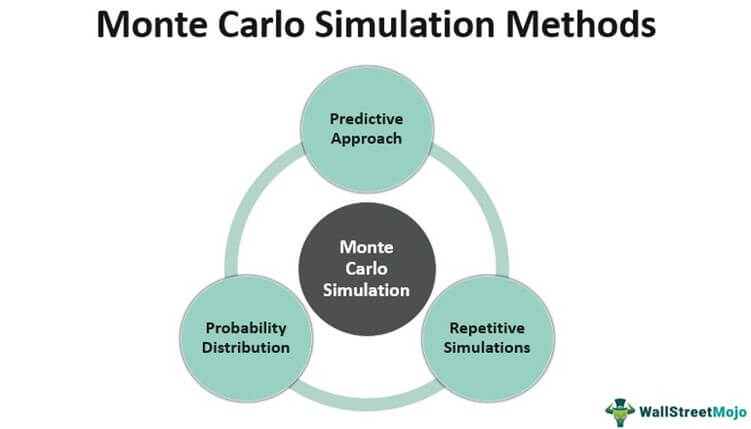

![PDF] Does the VaR Measurement Using Monte-Carlo Simulation Work in China?—Evidence from Chinese Listed Banks | Semantic Scholar PDF] Does the VaR Measurement Using Monte-Carlo Simulation Work in China?—Evidence from Chinese Listed Banks | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b75b3652192dcd07cb13a7c9029700b470349cd0/6-Figure1-1.png)

PDF] Does the VaR Measurement Using Monte-Carlo Simulation Work in China?—Evidence from Chinese Listed Banks | Semantic Scholar

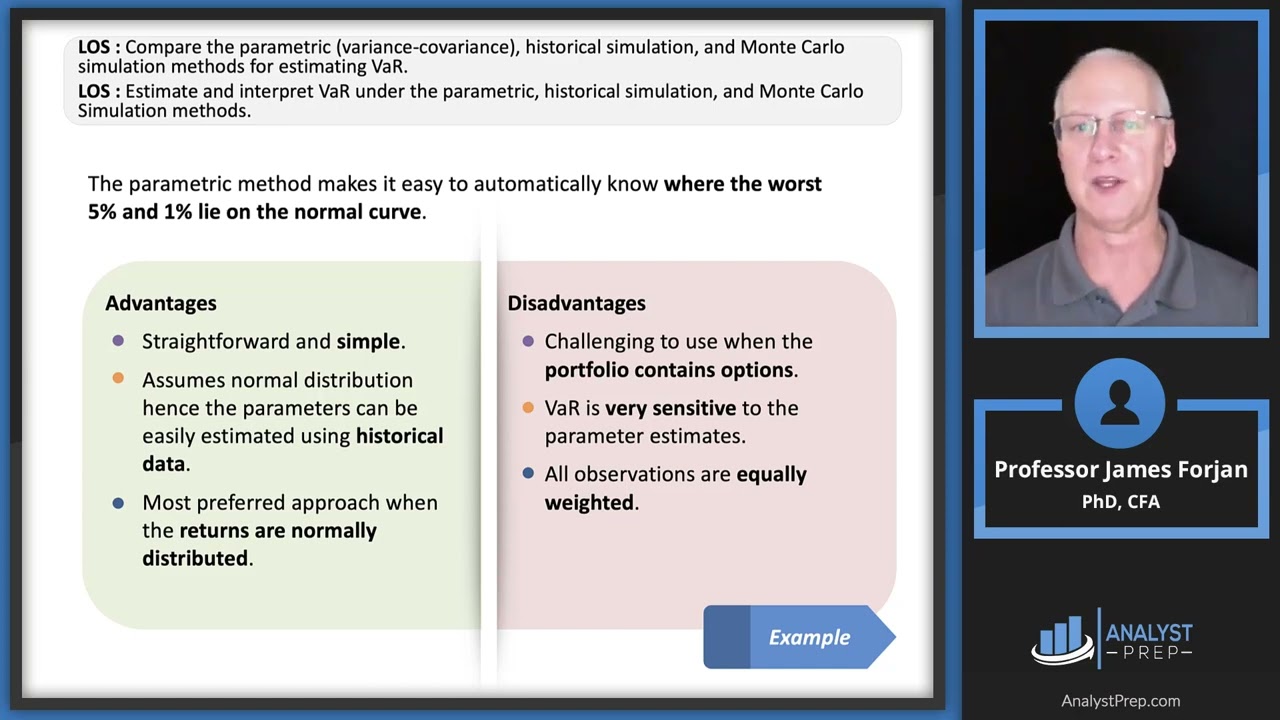

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)