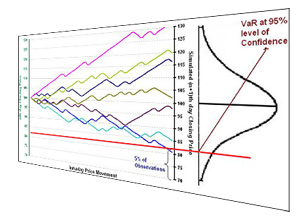

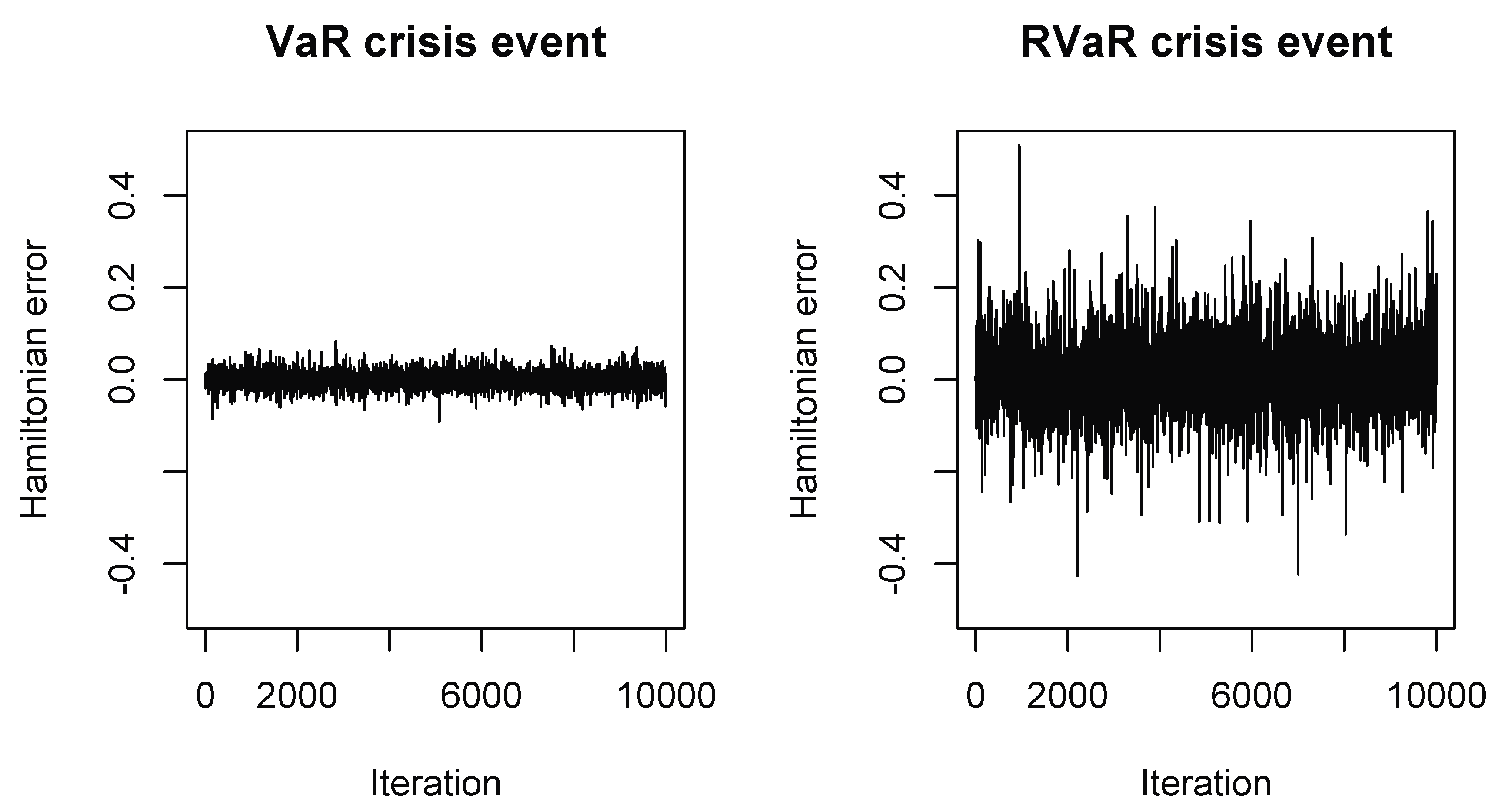

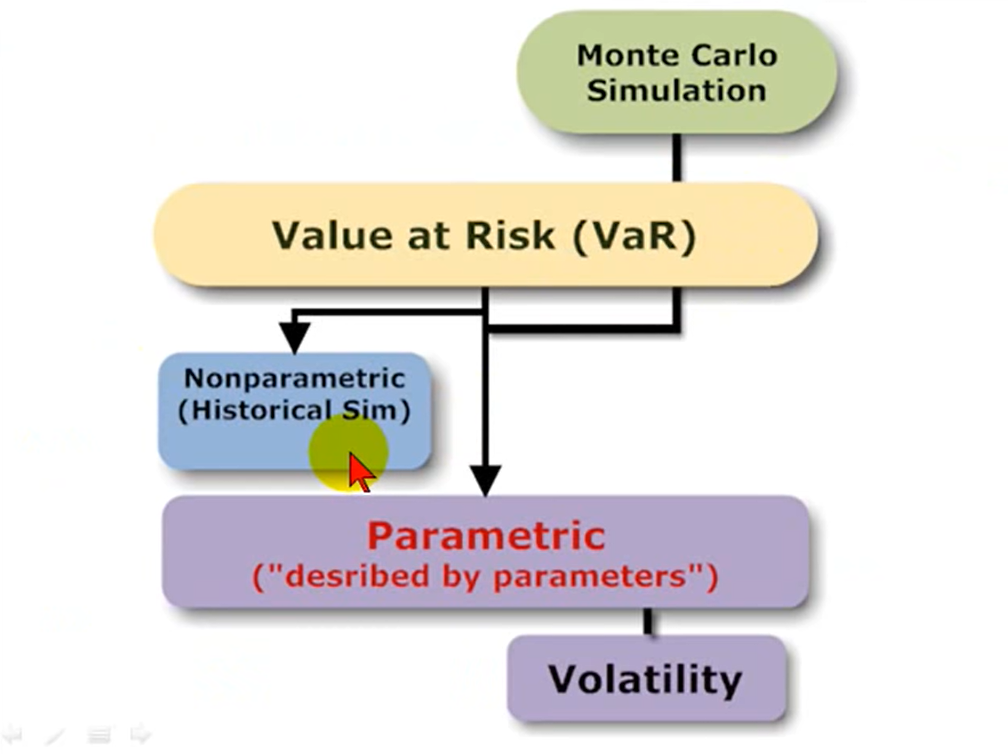

Here we show a visual depiction of the Value‐at‐Risk (VaR) estimation... | Download Scientific Diagram

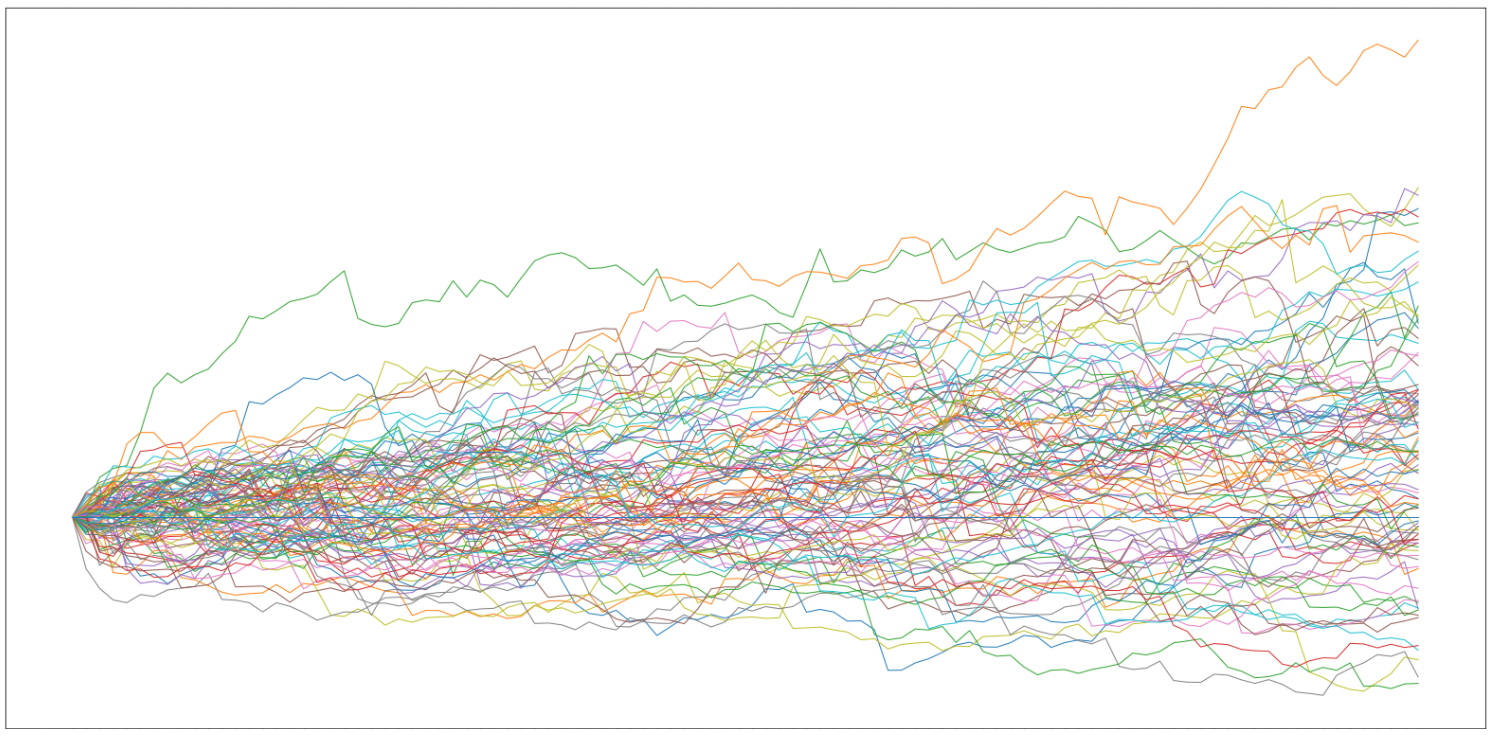

variance - Monte Carlo Simulation (estimating standard error using VAR function) matlab - Stack Overflow

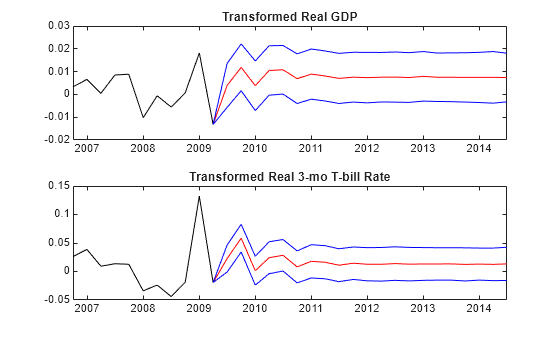

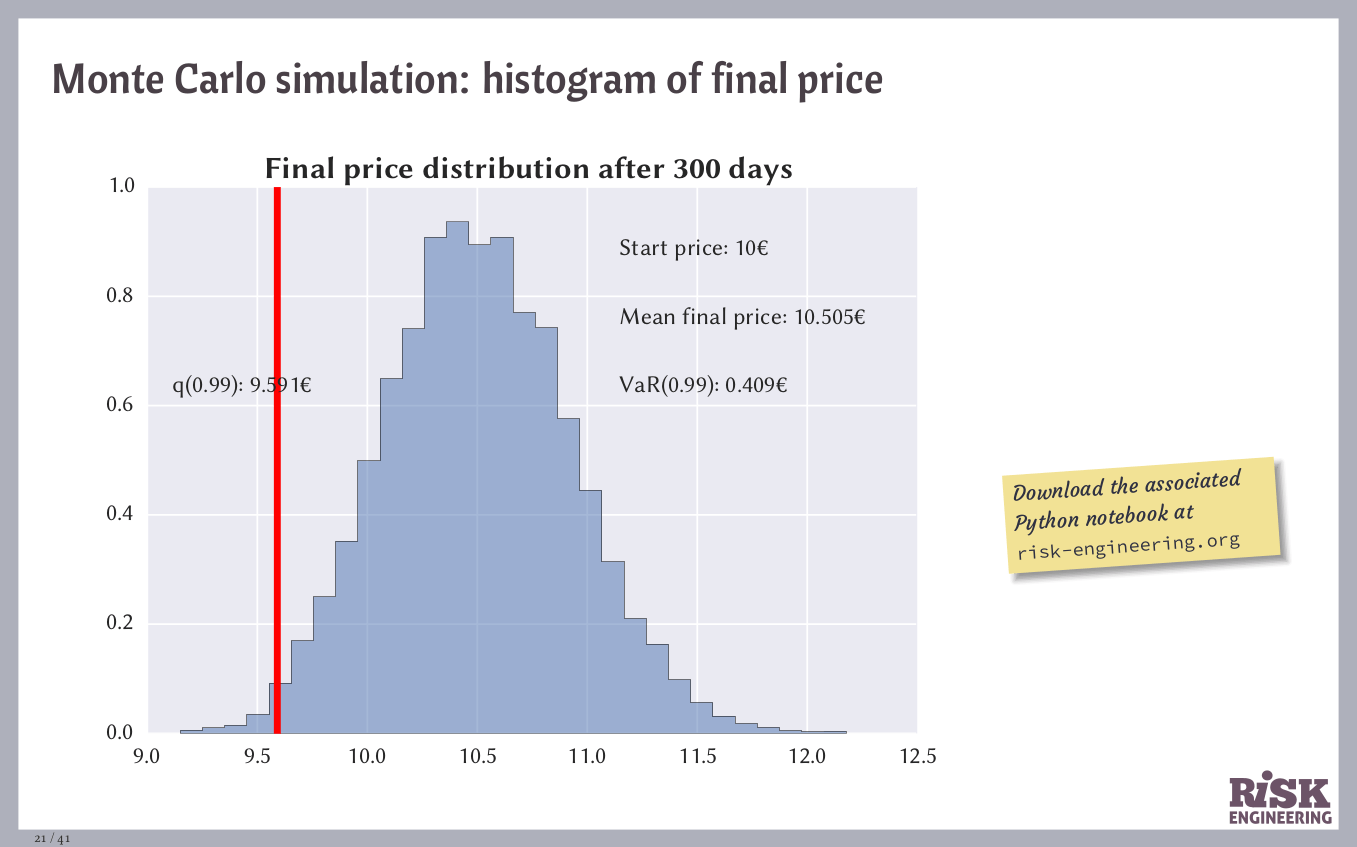

Sample Value-at-Risk estimates using the Monte Carlo simulation method... | Download Scientific Diagram

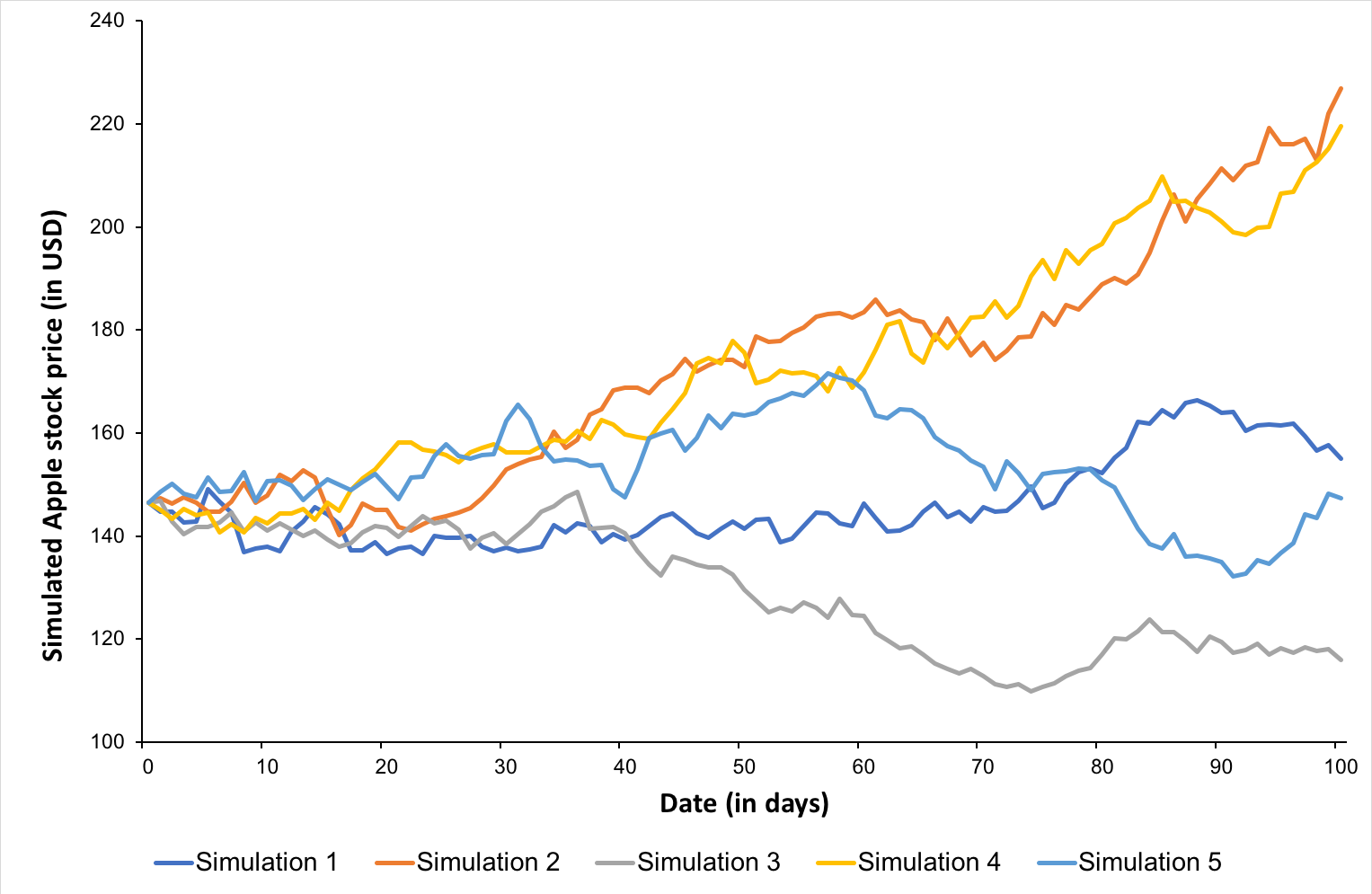

Monte Carlo Simulation with value at risk (VaR) and conditional value at risk (CVaR) in Python - YouTube

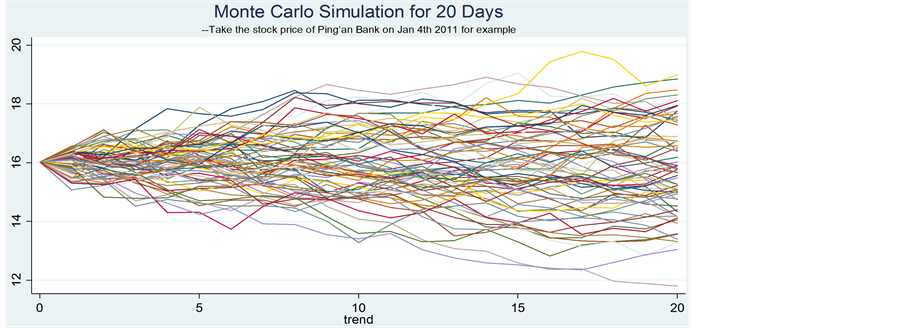

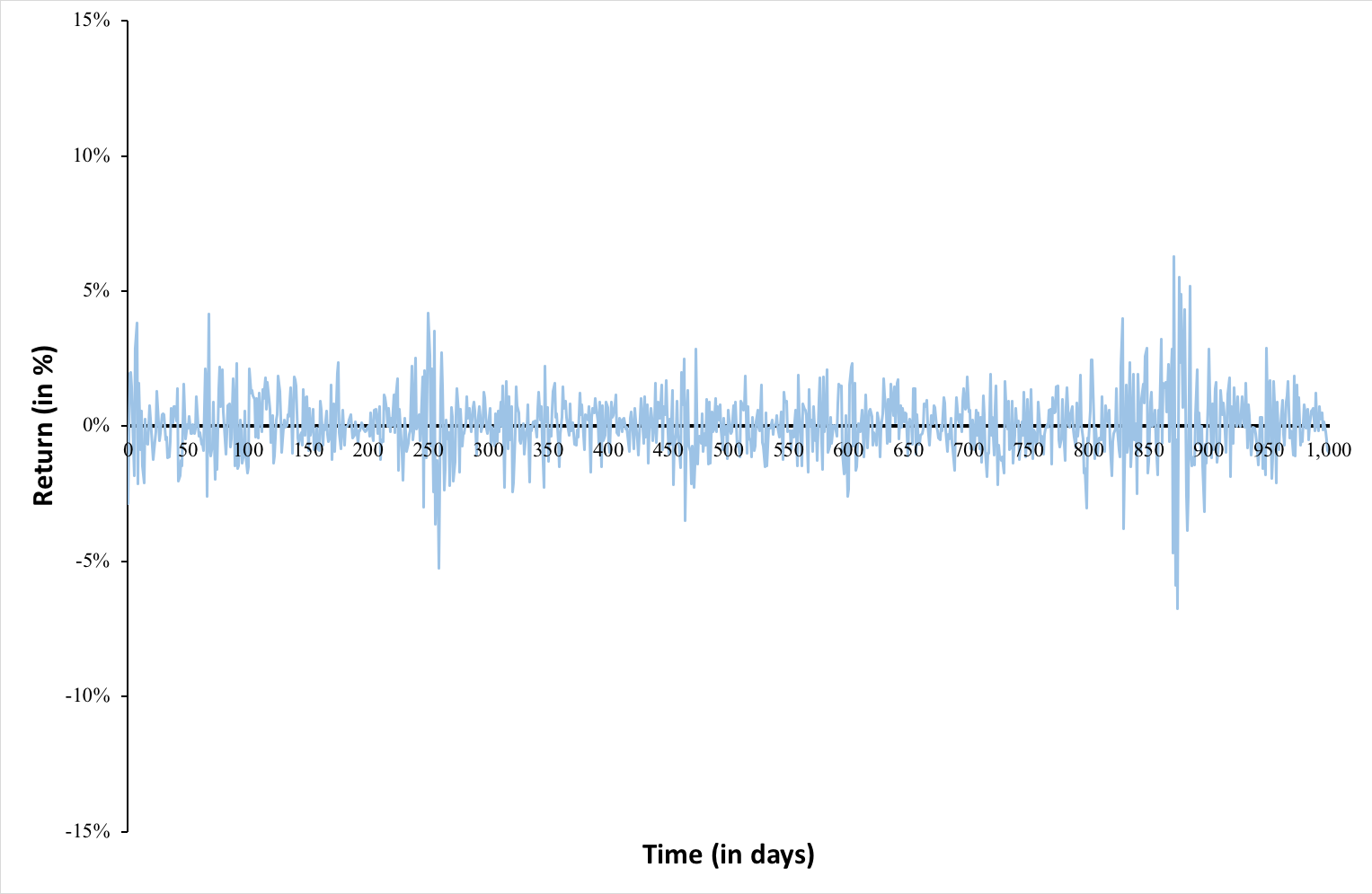

Monte Carlo simulation approach to calculate Value at Risk: application to WIG20 and mWIG40 / Metoda symulacji Monte Carlo w obl

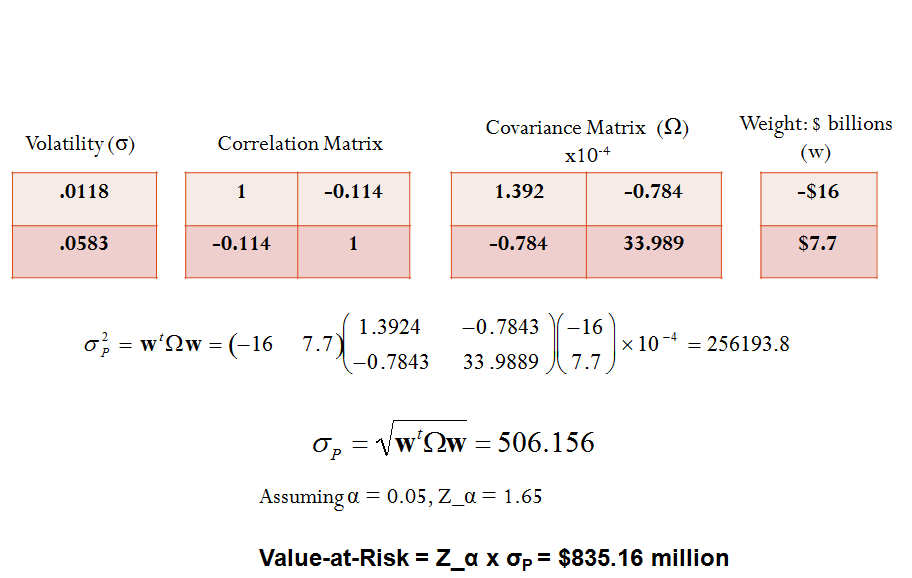

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)