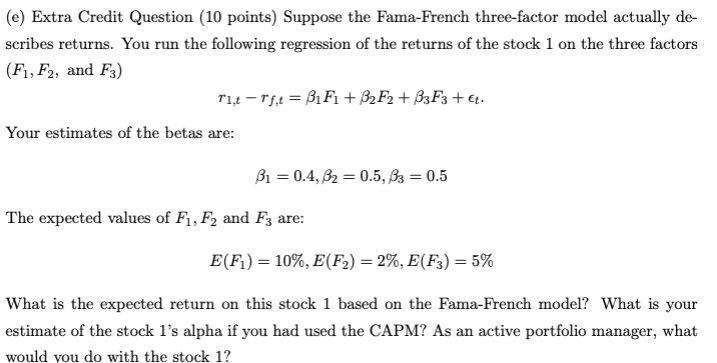

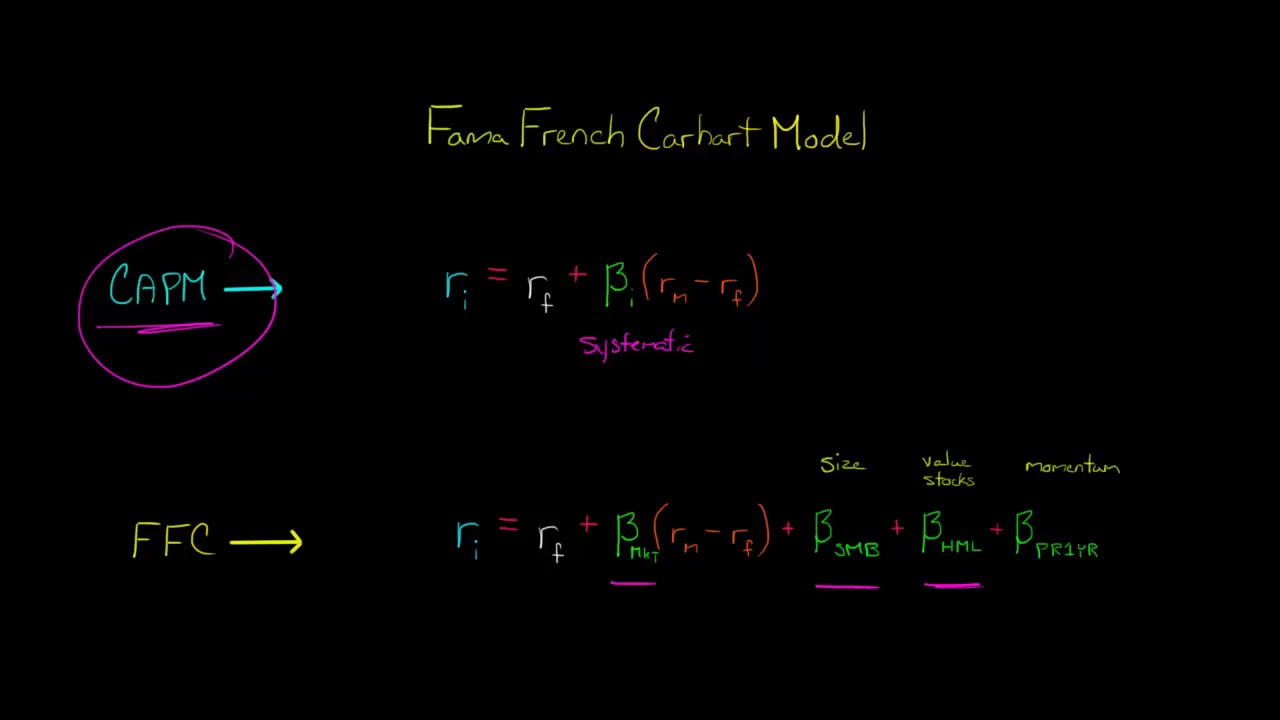

French and Fama Three Factor Model - What is the correct formula? - Quantitative Finance Stack Exchange

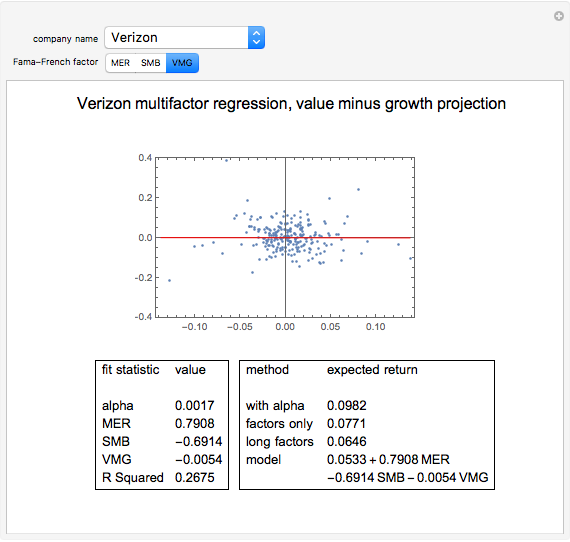

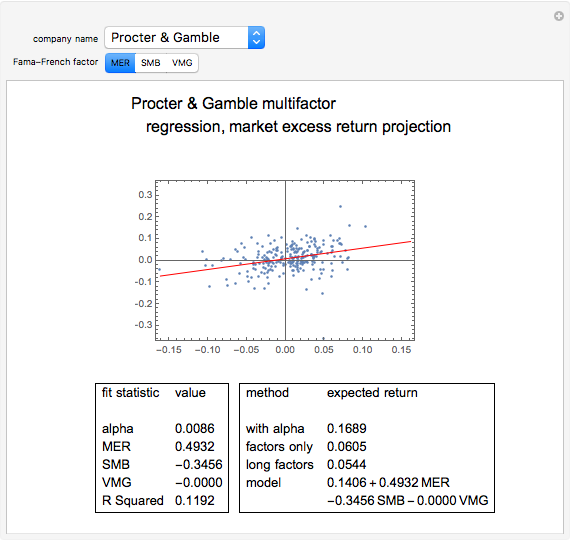

Demystifying the Fama-French Models: A Step-by-Step Guide for Estimation | by Blessing Atakli | Apr, 2023 | Medium

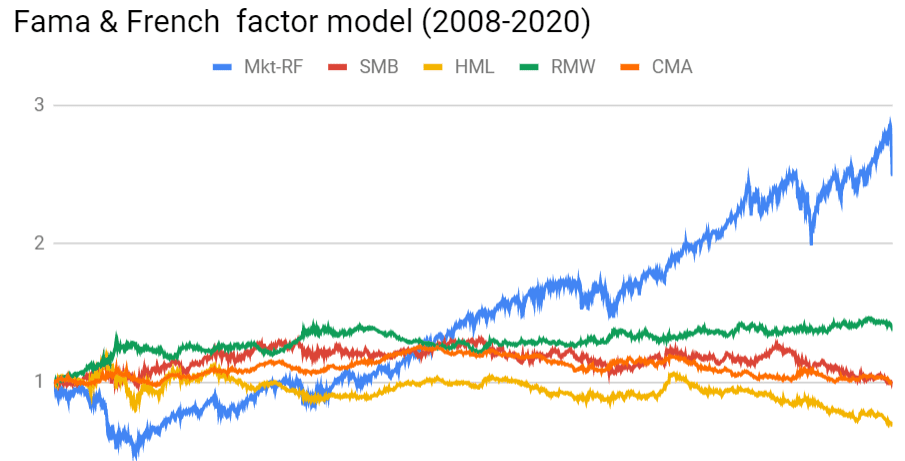

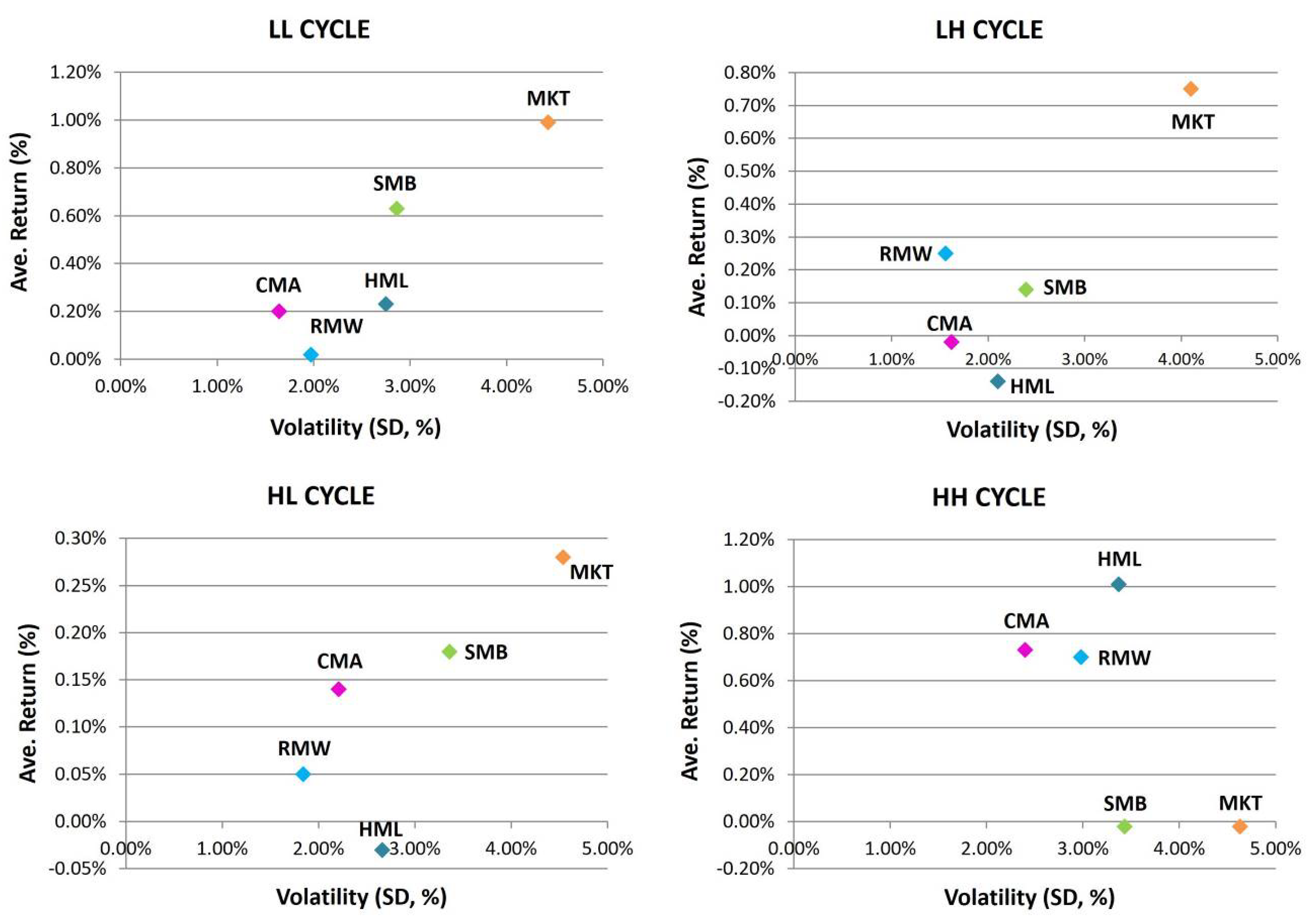

JRFM | Free Full-Text | Factor-Based Investing in Market Cycles: Fama– French Five-Factor Model of Market Interest Rate and Market Sentiment