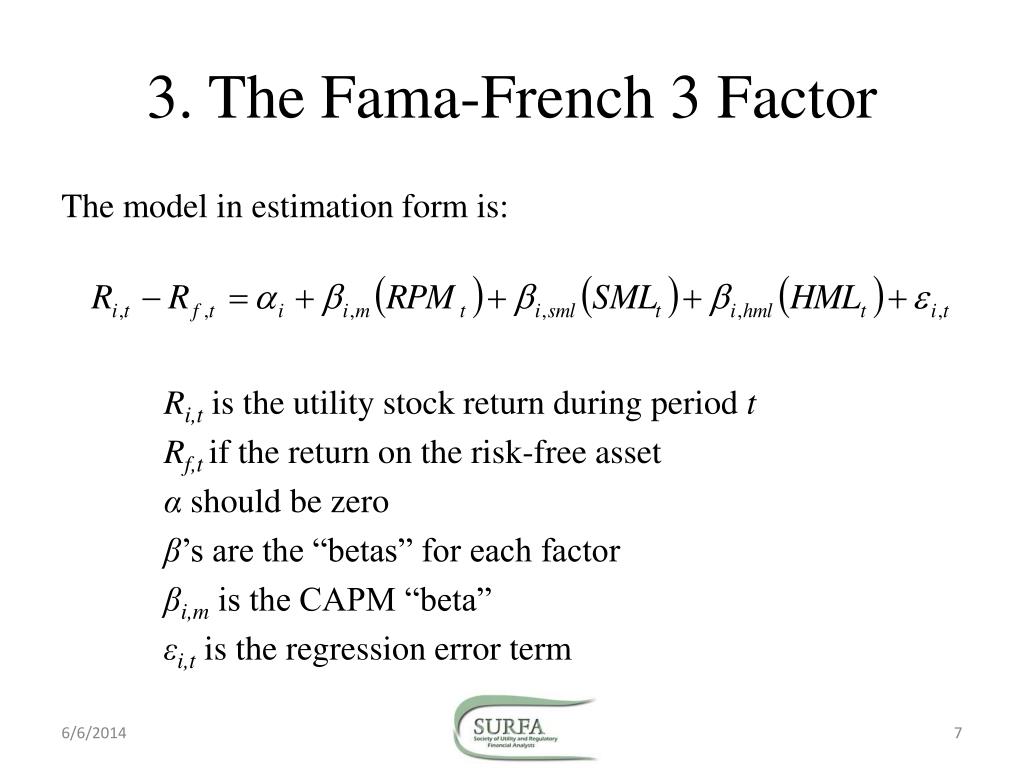

PPT - Fama -French 3-Factor Model: Theoretical and Conceptual Underpinnings PowerPoint Presentation - ID:1271475

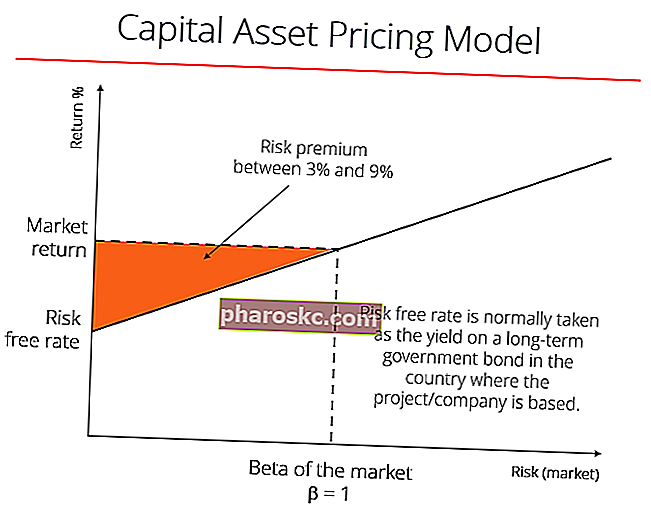

capm - Calculating the pricing error in Fama-Macbeth Regression for Fama/ French 5 Factor model - Quantitative Finance Stack Exchange

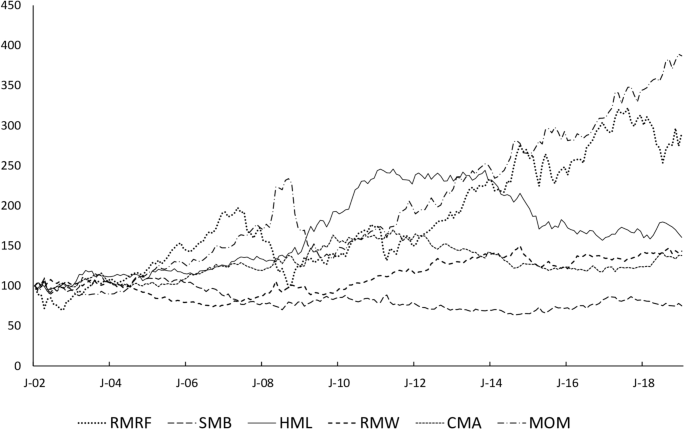

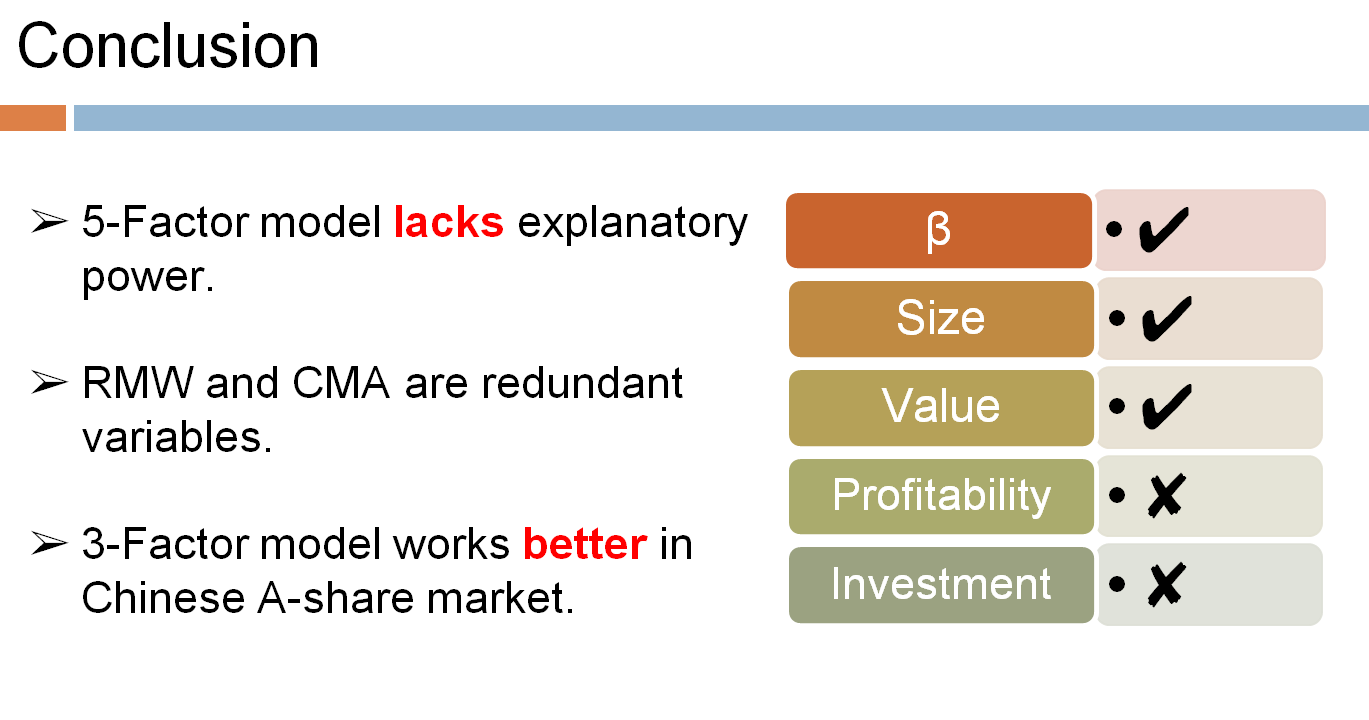

The conditional Fama-French model and endogenous illiquidity: A robust instrumental variables test | PLOS ONE

![PDF] Risk-return Predictions with the Fama-french Three-factor Model Betas | Semantic Scholar PDF] Risk-return Predictions with the Fama-french Three-factor Model Betas | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/9481b9d64c9da533a109c72f5c8e6ee85b67b1a3/5-Table1-1.png)

:max_bytes(150000):strip_icc()/fama-4196653-b2f48bc85216461ab6f626e63818552c.jpg)